In today’s digital landscape, safeguarding sensitive information is of paramount importance, yet traditional methods of protection are used that often fall short in the face of evolving cyber threats. Introducing our Tokenization as a Service (TaaS) solution – a cutting-edge approach to data security that combines robust protection with seamless usability.

But Distributed Ledger Technology is more than just a security measure – it is a catalyst for efficiency and compliance. By offloading the burden of data protection to our state-of-the-art DLT platform, your organization can streamline compliance efforts, reduce regulatory risk, and focus on what matters most- driving innovation and growth.

Our TaaS solution is a low code Asset tokenization Blockchain platform for Enterprises, built on Hyperledger Fabric. Customers can deploy scalable networks on cloud or regions of their choice. They can also bring their own cloud infrastructure if they want to deploy the network on their own cloud. Enterprises can then deploy our Asset Tokenization application on the network. Customers can define asset types, define dependencies among them, assign CRUD permissions on assets.

VenusGeo offers Consulting services, to provide a strategic direction given the multitude of choices that are available in both public and private Blockchain networks, after careful analysis of enterprise needs. We also offer a platform that is built on a permissioned network that can tokenize assets such as fractional ownership of real estate, securities, payments and utilities.

VenusGeo DLT Consulting

VenusGeo provides guidance, expertise, and support to individuals and organizations looking to understand, adopt, and implement blockchain technology. We also assist clients in navigating the complexities of blockchain technology to leverage its benefits for their specific use cases. As part of consulting, we offer

Blockchain Readiness Assessment

Evaluate the client’s business processes to determine the feasibility and benefits of integrating blockchain solutions.

Use Case Identification

Identify specific business use cases where blockchain can add value.

Technology Selection

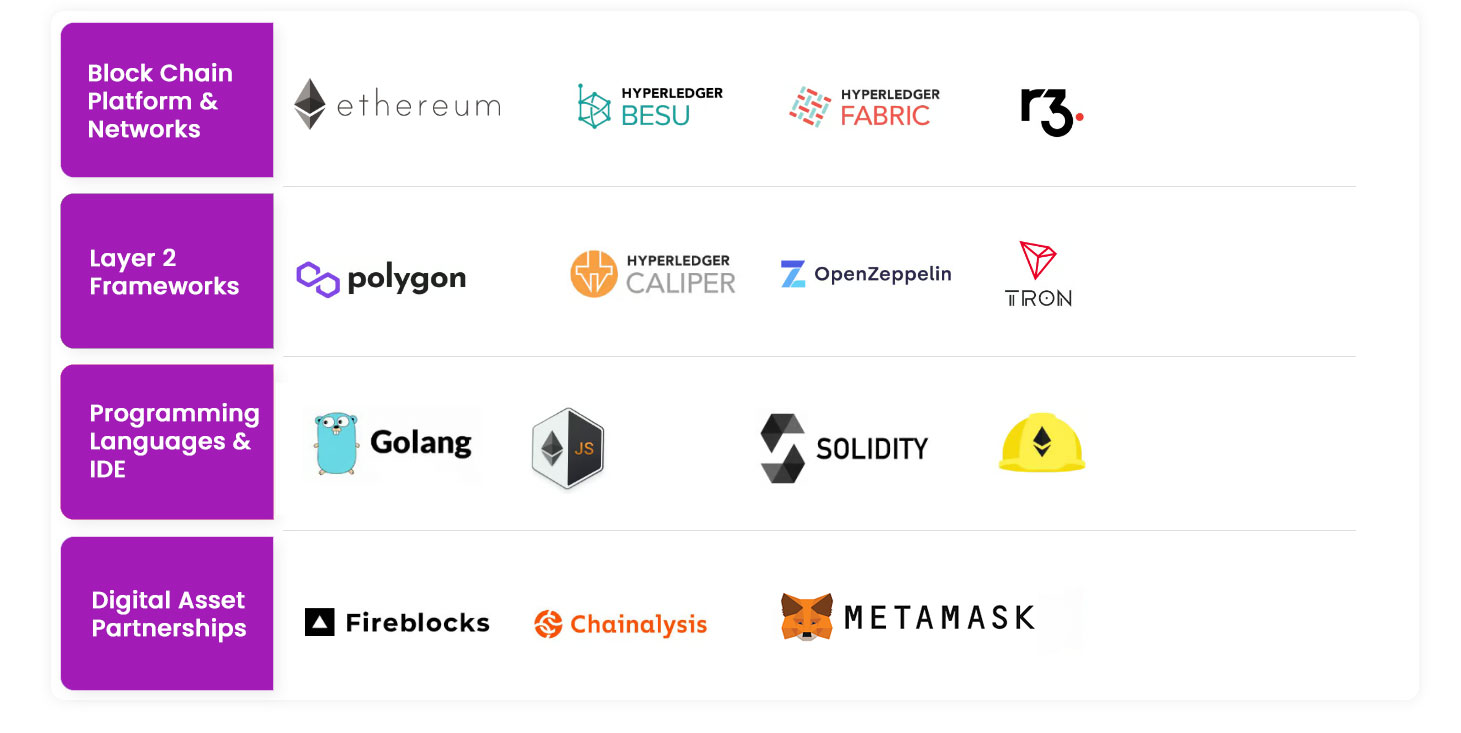

Platform Selection: Assist in choosing the appropriate blockchain platform between various choices based on the client’s requirements.

Consensus Mechanism

Help in selecting the right consensus mechanism for the desired level of decentralization and security.

Smart Contract Development

Design and develop smart contracts that automate and enforce business rules within the blockchain.

Blockchain Network Setup

Assist in setting up private, public, or consortium blockchain networks.

Security Audits

Conduct security assessments to identify vulnerabilities and ensure the robustness of the blockchain implementation.

Compliance Assistance: Provide guidance on regulatory compliance related to blockchain projects.

Legacy System Integration

Help integrate blockchain solutions with existing business processes and IT infrastructure.

API Development

Build APIs for seamless interaction between blockchain applications and other systems.

Workshops and Training Programs

Conduct training sessions to educate stakeholders on blockchain technology and its implications.

Documentation

Provide comprehensive documentation to facilitate understanding and future maintenance.

Project Planning and Execution

Assist in project management, ensuring that the implementation aligns with timelines and goals.

Risk Assessment: Identify and mitigate potential risks associated with the blockchain project.

Maintenance and Upgrades

Offer ongoing support for blockchain applications, including updates and maintenance.

Monitoring and Analytics

Implement tools for monitoring blockchain performance and analyzing user behavior.

Our Platform is designed for the tokenization of various types of assets, including securities like bonds, tangible assets such as real estate and for carbon accounting. The platform is built on Hyperledger Fabric. It allows customers to deploy scalable networks on cloud or regions of their choice. Enterprises can then deploy our platform on the network, defining asset types, dependencies, CRUD permissions and so on.

Financial institutions can more easily and inclusively conduct credit assessments and lending procedures by utilizing MSME Trade Financing to exchange customer data and credit information with reputable third-party suppliers. This structure facilitates loan availability for both individuals and enterprises, as well as competition and innovation.

The platform can facilitate trade financing, building a trustless network to enable the provenance and immutability needed to store invoices based on future cashflow, thus enhancing improved working capital financing for MSMEs at reduced prices.

VenusGeo designed a Private Blockchain network on the Hyperledger Fabric that allows multiple Loan Agents, Lenders, and all other participant roles to be onboarded, greatly simplifying the deployment of MSME Trade Financing on the network

Individual Network

A private blockchain network with various Loan Agents, Lenders, and other participant roles that may be onboarded is constructed on the Hyperledger Fabric.

Encryption of Data

Encryption at the object and field levels allows members of the same product network to share data within the parties involved in the transaction.

Security & Privacy of Data

It is up to the participants to determine what data should and shouldn’t be kept on the ledger. Distinct fabric channels that isolate data from other product networks for every product network

Simple Configurable Integration

Smart contracts can be created using no-code workflows for important procedures like loan repayment, conditional payout, KYC checks, etc.

Bring off-chain data into your system

Oracles can be used to obtain external data, such as KYC data, while smart contracts are being executed.

Workflow Builders

Configurable No-code workflows to create smart contracts for critical processes – like loan repayment, approvals, conditional disbursement, KYC checks and KYT (Know Your Transaction).

A digital version of a country’s official currency that is produced and overseen by that nation’s central bank is known as Central Bank Digital Currency (CBDC). In contrast to decentralized cryptocurrencies like Bitcoin, a governing body centrally regulates and oversees CBDCs.

Because they are backed by the central bank’s complete faith and credit, CBDCs are accepted as legitimate forms of payment inside the country. Central banks want to use digital technology to their advantage while keeping control over monetary policy and guaranteeing the stability of the national currency. To that end, they have introduced CBDCs.

VenusGeo has vast experience deploying a comprehensive CBDC platform for one of the world’s biggest democracies. Working with Central Banks, our team of professionals in CBDC can conduct research, design, develop, implement, and oversee interoperable CBDC systems at a large scale.

Developing the CBDC concept;

– Assessing and formalizing the technical architecture;

– Developing DLT and smart contracts;

– Integrating with current payment and central bank systems.

Adherence to security and regulatory specifications

Pilot program implementation and scaling up

Compatibility with national Blockchain solutions or other CBDCs